It is no big secret that insurance companies sit on potential goldmines of data. But extracting value from that data is easier said than done, with many data transformation projects across the world failing to reap their full benefits. Pieter Stel, an associate partner at Valcon, outlines how insurers can successfully adopt a data driven model.

Insurance companies today (both property & casualty, health and life insurance) face a range of challenges due to several converging developments in society, the technology space, and the world of insurance.

These developments are forcing insurers to take significant steps in future-proofing their operating model, including taking steps to improve processes, automation of tasks, digitization, and how customer needs are satisfied.

Among the dominant and emerging challenges insurance companies are facing are:

- New risks (e.g. cyber hacks, acts of war, climate change effects, instability on financial markets)

- Shifting client expectations (e.g. digital by design, service oriented, prevention oriented, need for transparency, connectivity, responsibility, inclusiveness and sustainability)

- Upcoming legislation and supervision adjustments (e.g. solvency II)

- Tech developments (e.g. AI, automation, microservices, cloud migration)

- Exploration of new distribution models

- New competitors (e.g. InsurTechs, new players in insurance ecosystems)

- Structural shift from office to home working (due to Covid-19 lockdowns)

- Retention of human capital (due to heated labour market)

Benefits of a data driven insurance company

Adopting a data driven approach can be beneficial to tackling most – if not all – of these challenges. The business value of being data driven can broadly be categorised into five domains: the customer domain, the operations domain, the finance domain, and the strategy, portfolio & innovation domain.

Better data and analytics in the customer domain will provide insurance companies with better insight into customer needs and behaviour, customer value, customer journey, net promotor score/satisfaction indicators and better targeted pricing, acquisition, cross-sell and retention actions.

Data in the operations domain of insurers can benefit among others, actuarial models, insights into the claims handling process, and fraud detection and the prevention of claims.

The finance domain will benefit from data through, among others, better forecasting models and good governance on risk & compliance processes.

Finally, the strategy, portfolio & innovation domain within insurance companies will also be boosted by a data driven uplift because it will enable a more fact-based approach to decision making, based on more accurate data analysis with a wider scope. Decisions that can be supported span the board, from the development of new products and services to entering other market segments or and exploring new distribution channels.

Obstacles on the way

The transformation to a data driven enterprise is easier said than done. Insurers face a lot of obstacles in their data maturity growth, such as fragmented and siloed data in various legacy systems, lacks of a data driven culture, no commitment from the leadership team, lacks of data analytics skills, data quality issues, and limited scale-up of successful data use cases.

Getting started

As many insurance companies don’t know exactly where to begin or proceed, kicking off with a maturity assessment is a logical starting point. Depending on the ambition, this may vary in scope and level of detail.

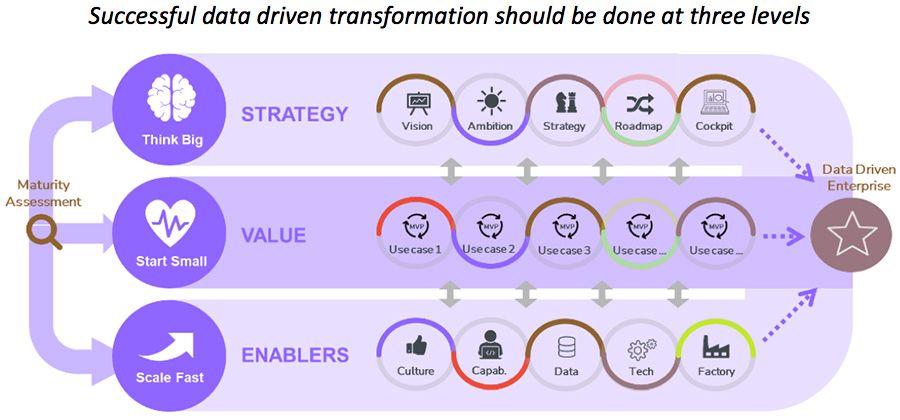

Based on the outcomes of this assessment, at Valcon we differentiate between three different data transformation streams or levels.

Strategy

The first stream is the strategy or ‘brains’ stream, in which insurance companies have the possibility to draft a data mission, vision, ambition, strategy, roadmap, and key performance indicators to monitor in a cockpit or dashboard. This stream is also regarded as the ‘brains’ stream.

Value

The second stream is the business value stream, in which a long list of use cases is inventorized and a limited number of potential beneficial use cases are piloted. This highly important stream is the heartbeat of the data transformation program and should guarantee that the business is committed and supportive of the change. This stream is considered the ‘heart’ of the data program.

Enablers

The third stream is the stream of developing data enablers or building blocks. This stream helps insurance companies build a solid data foundation. Data culture, data skills, data lake, data platform, tooling and governance are a few important blocks in this stream – therefore regarded as the ‘body’ of the transformation.

Fuente: www.insurtechinsights.com